See Peter Krauth and Ted Butler at the Metals Investor Forum in Toronto February 27-28!

-Jeff Clark, TheGoldAdvisor.com

I’m calling it. The countdown to when money starts flowing into the junior stocks has begun.

I hate making predictions, and I’m not saying it’s imminent, but in my opinion the fuse for what will drive investors into our sector has been lit.

There are lots of reasons one could come to this conclusion. A relentlessly rising gold price. The Fed cutting interest rates. Recession, stock market decline, monetary easing. In my opinion all those things will come. But the fuse has been lit by another factor, based on a table you gotta see…

The average gold price in Q2 this year was $2,337.98. It averaged $1977.84 in Q2 a year ago. That’s an increase of $360.14, or 18.2%, over 12 months. That’s a significant gain in 12 months for what is essentially a static metal.

And it had a significant bearing on the profits of producing companies. Inflation had been rising of course but had begun to plateau and was already figured into costs. So, the higher gold price went directly to the bottom line.

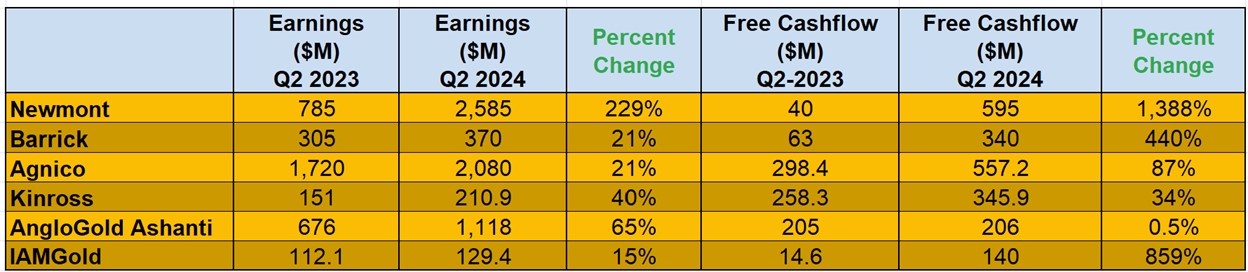

We tracked six large gold producers and documented what happened to their earnings and free cash flow (FCF) because of the higher gold price.

We compared their earnings and FCF from a year ago and here’s what we found. Note the percent change columns.

All of these producers saw double digit increases in earnings year over year. Newmont registered a triple digit increase.

For free cash flow, which many analysts consider the ultimate gauge of corporate health, two saw double digit increases, two registered triple digit increases, and one saw a quadruple digit increase. Only AngloGold Ashanti had flat FCF year over year.

These strong increases have powerful implications.

First, it strengthens a company’s ability to pay down debt, pay dividends, buy back stock, and ultimately grow the business. That growth could include M&A of the more attractive juniors, too.

Second, it puts lots of “green on the screen” for investors, including Wall St, Main St, and those within our industry that have been waiting on the sidelines. It makes miners appealing investments, both now and when the broad markets get weak, and investors are looking where to put money.

Third and the most important reason the countdown has begun is because, as most gold mining investors know, the flow of capital in a new bull market starts with the metals themselves. That’s clearly underway, with gold now breaching $2,500 per ounce. Next is the flow of money into the senior companies—and we now have the impetus for that to begin. And then it’llmoves down to the developers, and then the juniors.

In other words, based on history…

I believe the fuse has been lit. While we can’t pinpoint the exact timing, the opportunity to secure your position in junior mining stocks is narrowing.

Do you have your stocks picked out?

I have what I consider to be the strongest candidates, and I’m actively adding to them on dips. Plus, I have more on the way.

In 2023, my portfolio was up substantially from some of my top stock picks:

You can access all of these in the Paydirt Prospector—my personal portfolio of gold, silver, uranium, copper and lithium mining stocks.

These are the junior stocks I believe stand the greatest chance of benefiting when money begins pouring into the sector. It’s coming, and it’s time to make sure we’re ready. Are you?