In my last few issues I discussed the technologies involved in solar panels, and how they not only need silver, but require increasing amounts of the precious metal. I also examined that increasing demand and why it looks primed to continue climbing unabated for years, if not decades.

In this article I’m going to take a stab at whether we’re going to have enough silver to meet the growing demands being forecast.

First let’s start with what we know.

Back in 2014 industrial demand was 43.6% of total demand. By 2020, that had reached 50%. This year it’s forecast by The Silver Institute to maintain that level of about 50%. Unless investment demand surprises dramatically to the upside, I think that industrial demand will come in a bit higher than the Institute forecasts, probably around 52% or 53%, mainly due to blistering growth in solar panel production.

In fact, Metals Focus, which performs the research for The Silver Institute, has been adjusting its outlook for industrial silver demand in recent updates. In a report from early August, Metals Focus used the headline: “Silver industrial prospects bright as record high PV installations counter weak GDP”. They highlight how silver industrial fabrication notched back to back highs in 2021 and 2022, with volumes up 16% over 2010 levels.

Metals Focus notes that a softening economic outlook may have weakened demand for silver from consumer electronics, home appliances, and even the construction segment. But they counter that, remarking how healthy growth and adoption of photovoltaics (PV) and EVs are buoying total demand, suggesting persistent structural deficits in the silver market for the foreseeable future.

A number of institutes and research providers have also been raising their forecasts for solar power capacity on the heels of a new record first half in 2023. S&P Global upped their target for this year by 30 GW to 360 GW, while PV Infolink says added capacity will reach 351 GW. Bloomberg New Energy Finance boosted its installed capacity forecast from 316 GW to 346 GW. And Solar Power Europe raised its forecast for new capacity by fully 33%, and 42% for 2024. Meanwhile, for 2025 they’ve revised their expectations even higher by 47% and by 54% for 2026.

Metals Focus now admits that, considering such hefty revisions for the next 2-3 years, they could see an additional 28 million ounces of demand in 2025 and 48 million ounces in 2026, barring any silver replacement.

In terms of costs to manufacture solar cells, silver paste is second only to silicon wafers. In the currently most common PERC technology, silver paste is about 8-9% of total cost, for TOPCon it’s 10-12%, and for HJT it’s 14-16%.

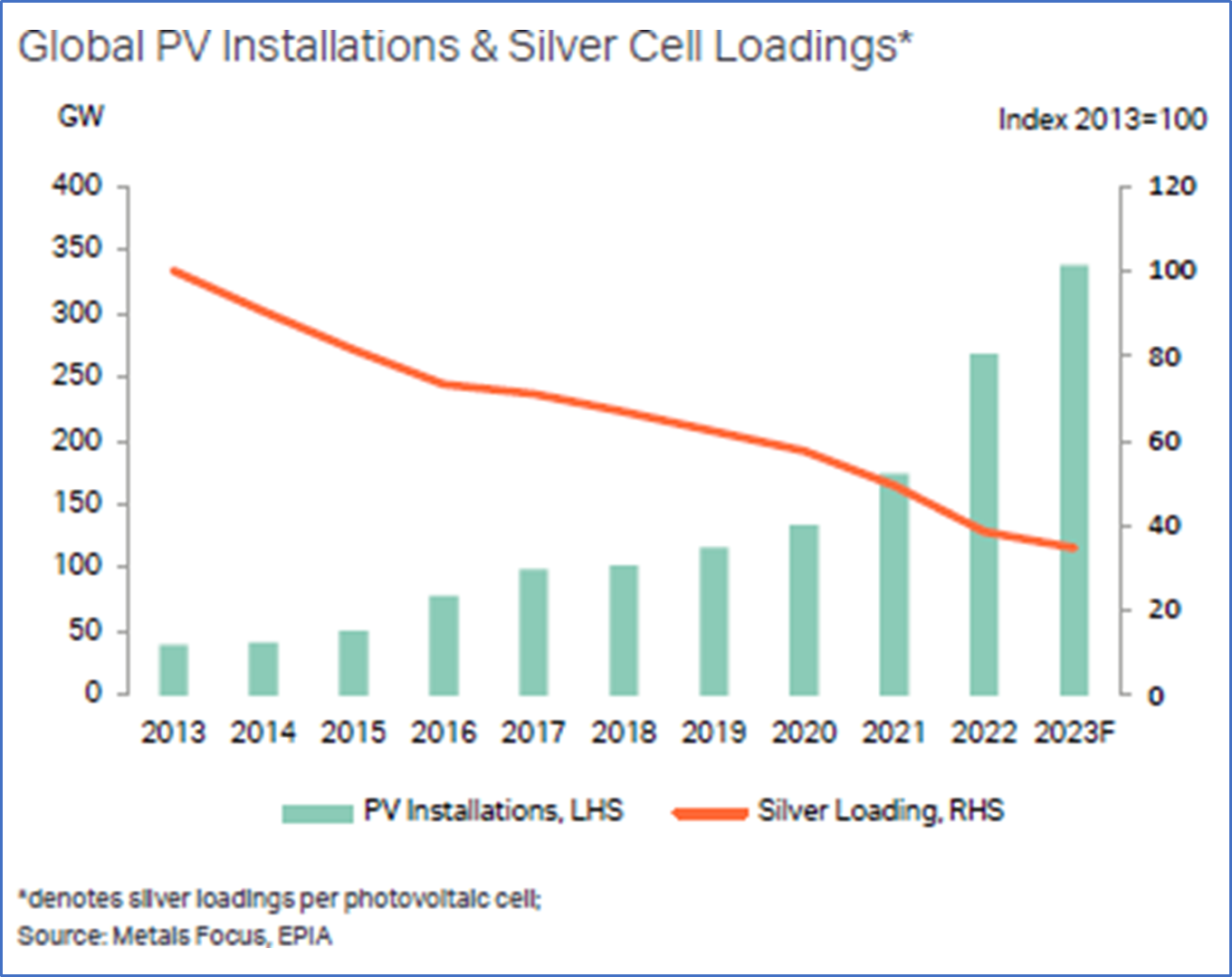

The orange line in the chart above indicates the amount of silver required for each solar panel. I think we’re at an inflection point, and that the direction is about to reverse and head steadily upward soon.

While other metals like copper are constantly being tested, they remain unproven, and modifying production lines is very costly. At current prices, and well up to $30/oz., solar panel manufacturers remain very profitable.

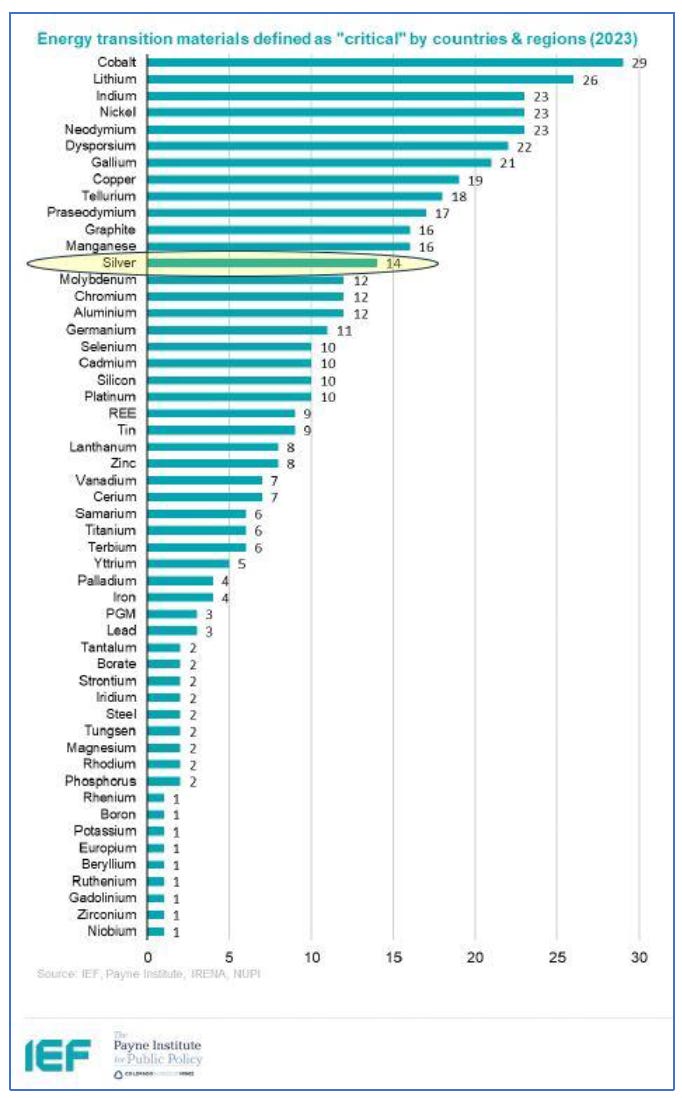

Consider that many nations are beginning to view silver as a critical mineral. The International Energy Forum released its Critical Minerals Outlooks Comparison, a meta-analysis of 11 reports that looked at various energy and technology scenarios aligned with global climate goals. As it turns out, 28 different minerals and metals were mentioned in all 11 reports. Interestingly, the results show that fully 14 countries and regions considered silver to be a critical energy transition material.

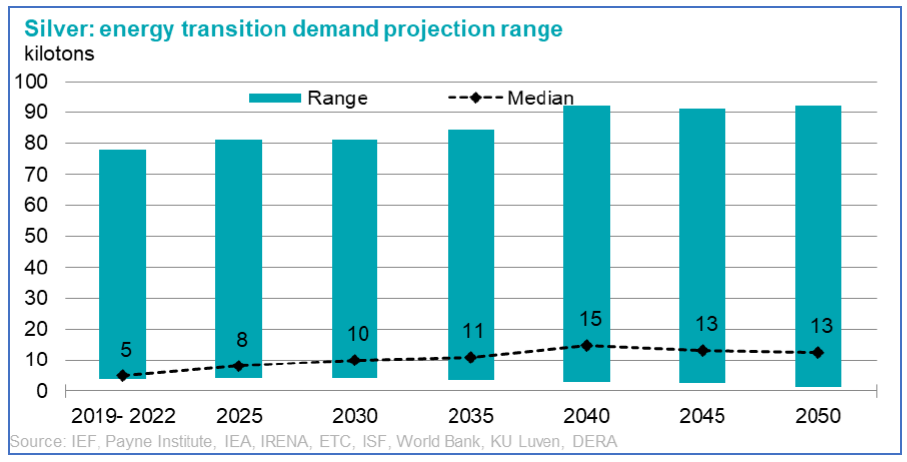

The range of demand projections is quite large across the various reports, but the median forecast is that silver requirements to meet energy transition targets is set to double from about 5 kilotons (roughly 176Moz.) of silver to 10 kilotons (roughly 352Moz.) by 2030, and to triple by 2040 to 15 kilotons (528 Moz.). Ten kilotons is fully one third of current annual supply, and 15 kilotons is 50% of annual silver supply.

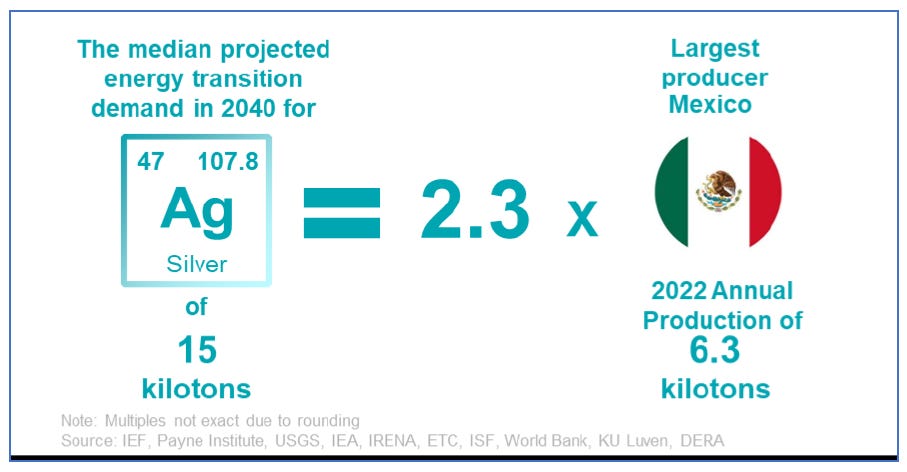

Fifteen kilotons, or 528Moz. is the equivalent of 2.3 times annual production from Mexico, the world’s largest producer at 6.3 kilotons annually.

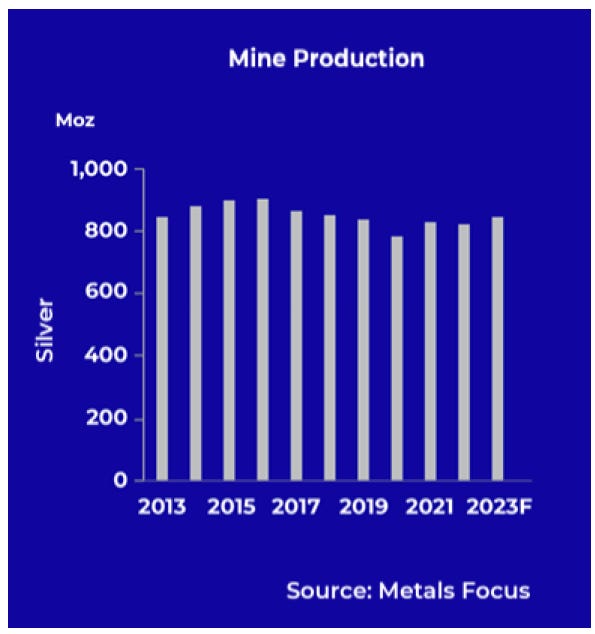

Meanwhile, we can see from the next chart that silver mine production is struggling. Projected mine output is about 850Moz. for 2023, which equals levels reached back in 2013. Output appears to have peaked in 2016. It’s possible that we’ll see mine output continue to rise. My research suggests that if most demand categories remain close to current levels, just the increase in solar demand will outpace mine supply growth.

And yet, I don’t expect silver demand to remain stagnant in categories outside solar. It’s needed in electrical and electronic applications, not to mention military inputs and EVs. Silver helps augment the efficiency of chemical reactions. Silver is crucial as the only catalyst that oxidizes ethylene gas into ethylene oxide, used to make polyester textiles for clothing and specialty fabrics. Silver is increasingly being used in health care, reflectants, telecom, superconductors, electroplating, brazing and soldering, photography, mirrors and coatings, water purification, printed circuitry, and much more.

As a result, I see industrial applications steadily growing demand for this precious metals. I think that will put a rising floor under the silver price. Layered on top is investment demand: the wild card. I expect investment demand to come in waves that will increase silver’s price volatility, and push it much higher as the fear of missing out, or FOMO, causes future silver squeeze events.

If you would like to read the full letter, you can subscribe to Silver Stock Investor here.