See Peter Krauth and Ted Butler at the Metals Investor Forum in Toronto February 27-28!

I like to call silver the “Rodney Dangerfield” of precious metals: it just doesn’t get the respect gold does.

Why is that? Well first, gold is more valuable than silver for the same weight. In other words, it’s more concentrated wealth. That’s made gold the asset of kings and queens, and a top choice for jewelry.

But in part because of its lower per unit weight value, silver has been more practical as everyday money. It’s considered to have been responsible for a higher value of transactions throughout history. In other words, silver’s been daily money for about 5,000 years. Not even gold can say that.

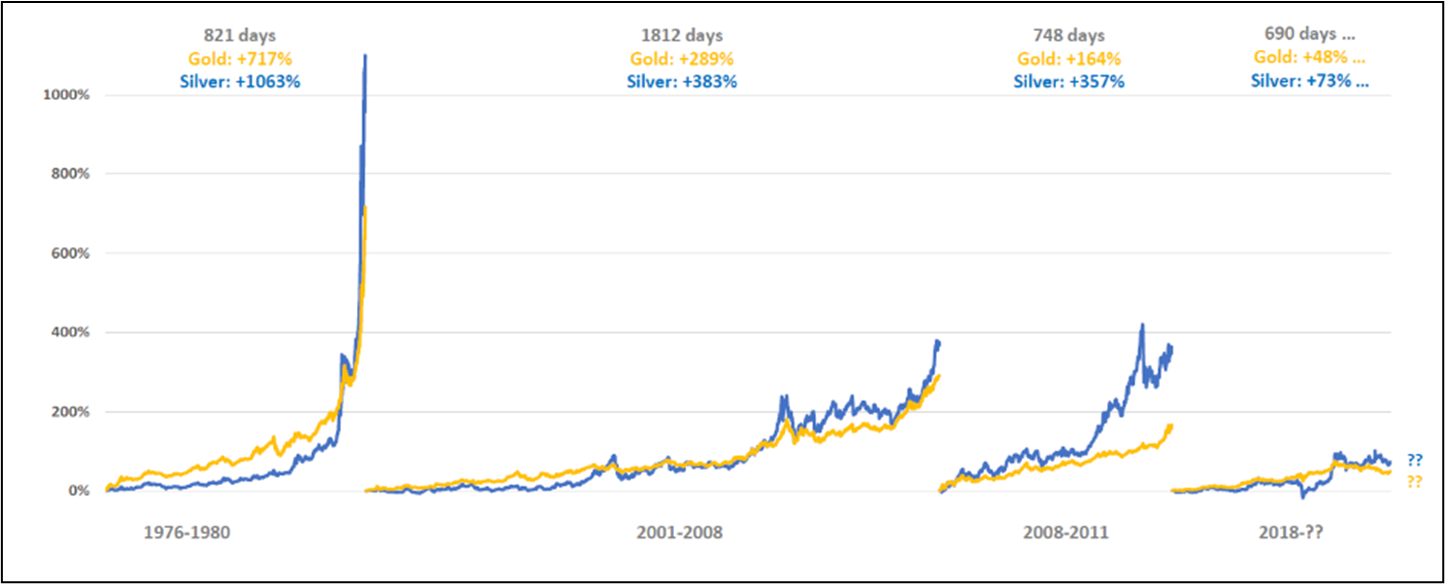

What we do know is that silver follows gold, with a lag. But when it starts to catch up, it tends to outpace its more valuable cousin. This chart shows the last four main silver bull markets. We can clearly silver rise at the same time as gold, then catch up and generate even larger returns by the end of the bull.

Gold has been in a high consolidation range since 2020, and has been mostly above the $2,000 level for the past three months straight. And now it’s just set a new all-time closing high.

Yet silver’s performance has been subdued. It’s still less than half its $50 high in 1980 and its $48.60 peak in 2011.

This chart shows percentage gains of both metals on the same chart. What you see is that silver ultimately gained more than gold in both of those bull markets.

In the next chart, we can see silver rallied very strongly twice since its secular bull started in 2001.

Between 2009 and 2010, silver doubled from almost $10 to just under $20. Then it went on to gain another 150% to reach just under $50 in less than 12 months. It was a breathtaking total gain of 400%. During that same time, gold managed to double from about $770 to $1,550. That’s still impressive, but it was dramatically outperformed by silver.

Then when the COVID-19 pandemic panic hit, silver ran but not before gold. The yellow metal rallied by 33% in the first seven months. Silver actually rallied from $18.50 at the start of the year to nearly $30 by August, printing a 58% gain.

Then we have the Gold-to-Silver Ratio which suggests silver is still a dramatic bargain versus gold.

This ratio has only managed to rise above 89:1 four times since 1995. You only have to look back to 2019. Each time that happened, silver rallied strongly in the following months. The largest fall in the ratio came after it peaked at an all-time high of 125:1 in March of 2020, just as the COVID pandemic panic peaked. Over the next 5 months the ratio collapsed to 70. Gold rallied 35%, but silver catapulted by 140%, for a blistering 4-1 outperformance.

Why does silver behave this way?

It’s thought that a likely reason is that silver becomes a FOMO Target. FOMO is an acronym for Fear Of Missing Out. When gold rallies strongly and attracts a lot of investors who are new to precious metals, many will look at gold and decide it has become too expensive.

Imagine for a moment that gold rallies to $2,500, while silver rallies to $35. Many will look at gold and consider it is too costly, then turn their attention to silver. At $35/oz. silver will look a lot more attractive…and affordable. Many investors will feel they can get so much more for their investment dollars by buying silver rather than gold.

We already know from market fundamentals that silver is in a structural deficit, and that that is expected to continue for several years. Mine supply and recycling are struggling at best. Demand is growing, led by solar and electronics, and in my view investment demand will bounce back strongly this year.

With all this in mind, the bullish setup for silver is clear. Pending rate cuts, possible renewed bank failures, a recession, election volatility, and maybe even a return of the Fed’s operation twist all support higher silver prices.

The stage has been set. We just need to wait for the show to start.