See Peter Krauth and Ted Butler at the Metals Investor Forum in Toronto February 27-28!

If you haven’t met our senior analyst Ted Butler, he actually withdrew from his master’s in finance degree, after becoming disillusioned by the status quo of 60/40 portfolios and the omission of gold and silver from the curriculum. He’s one sharp cookie, and he just completed some research on the question on everyone’s mind: is the top in for gold and silver mining stocks? -Jeff Clark

-Ted Butler, Senior Analyst

Gold is on track for its best annual performance since 1979, silver has skyrocketed to $48 for the third time since 1980, and the junior mining stocks—as measured by GDXJ and SILJ—are up some 130% year to date.

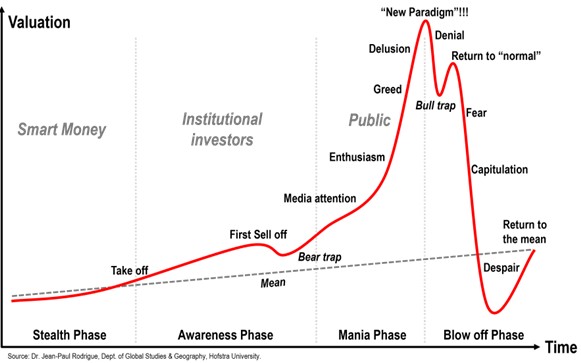

Naturally, you’d be forgiven for thinking that this bull market is approaching its “endgame” – the so-called mania phase where irrational exuberance runs high and objective analysis takes a back seat.

In doing so, you’d be quite mistaken. That’s because mining stocks still have plenty of room to run relative to historical cycles, especially as many of them are rocking record-high free cash flows and profit margins to boot.

At the same time, we are by no means at the “bargain basement” prices from earlier this year. Arguably, that train left the station for good on August 1st, with GDXJ and SILJ both going on to perform over 60% since then.

As a result, many of you may be confused as to what phase of the precious metals bull market we’re really in. And by extension, you’re probably debating if you should buy more stocks, wait for a dip, or take some profits.

Fortunately, today’s article will set the record straight as to where we’re at in the current cycle. From there, it will be up to you, our esteemed reader, to take decisions according to your own risk tolerance and time horizon.

What Are the Phases of a Precious Metals Bull Market?

There are 4 distinct phases in a bull market, with the first being the “stealth phase”. This is the period where sentiment is bearish, and stocks are undervalued – the perfect storm for the smart money to get positioned.

If you hadn’t already gathered, we believe gold and silver stocks are now beyond that “stealth phase”. In fact, we would argue that we are in the middle of, or even towards the end of, the next phase called the “awareness phase”.

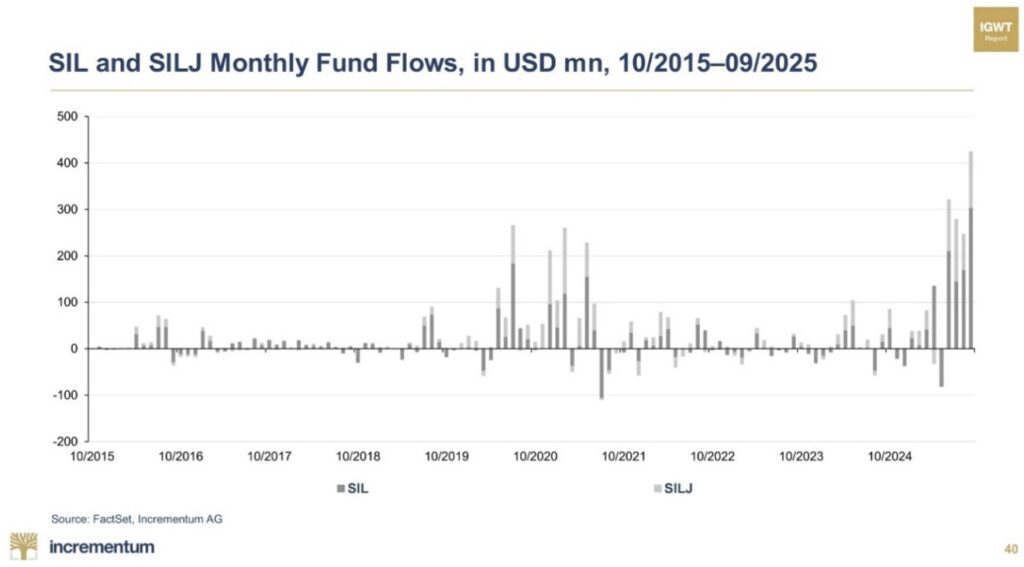

In part, that’s because gold mining stocks just raised a record $6.7 billion in equity in the third quarter, as per Bloomberg. During this time, SIL and SILJ also enjoyed decade-high fund flows to the tune of more than $1 billion.

Source: https://ingoldwetrust.report/monthly-gold-compass/?lang=en

With these kinds of capital inflows, it’s safe to say that the institutional activity is starting to heat up in our little industry. On the micro level, this can be seen in the plethora of financings all announced less than 10 days ago.

On the macro level, our position in this “awareness phase” is solidified by analyst upgrades, the stocks starting to outperform the rocks, and the creation of new investment vehicles like Sprott’s new actively managed ETF.

The healthy pickup in M&A also served as some pre-emptive evidence that the awareness phase was about to enter full swing in 2025, with the number of deals in gold mining increasing by 32% from 2023 to 2024.

Consequently, the next question in our bull market diagnosis becomes:

Are We in The “Mania” Phase Yet?

In short, the answer is no. That’s because, for us to say yes, we’d need to be seeing the hallmarks of the mania phase, which is characterised by media attention, enthusiasm, greed, delusion, and ultimately the market top.

Not only are we not seeing those hallmarks, but we’ve also not seen the final features of the awareness phase, which typically culminates with a ~20% intra-bull market correction, regarded by traders as a “bear trap”.

We’re also yet to see substantial public participation in gold and silver stocks from the generalist investors, despite the metals themselves making headlines in the pages of the Financial Times and The Economist.

Just as importantly, past cycles show that the generalist institutions – names like J.P. Morgan and Goldman Sachs – tend to enter the space later, once the cycle is more mature and deal sizes justify their participation.

In the 2000s bull market, these behemoth banks only began underwriting and syndicating major financings after the metals had already surged and generalist capital was flowing freely into the sector.

Incidentally, the absence of these marquee banks in the gold and silver financings of today is another clear signal that we are still firmly in the awareness phase, not yet entering mania.

If we were in mania, you’d be hearing phrases like “this time is different” and “new paradigm”. At that point, the mining stock buzz will be inescapable, from TV talking heads to your taxi driver turned mining analyst.

The good news is we’re not there yet. What we are seeing, though, is the first hints of public participation – the stage where your neighbour might mention it in passing, not where the whole street thinks they’re an analyst.

Therefore, while we do expect a pullback or two in the short-term, we maintain that mining stocks have a lot further to run. “How much further?” you ask. Well, with history as a guide, we may not even be half way yet.

My rationale is grounded in the historical performance of mining stock bull markets gone by. With help from my colleague, Jeff Clark, and his must-read book, PAYDIRT, the next section explains exactly why.

From 2001-2008, selected gold stocks returned an average of 972%, while selected silver stocks produced an average of 1,612%. During that period, the gold price increased 295%, with the silver price rising by 362%.

Taking its October 2022 low around $1,627 as this bull market’s bottom, gold has surged 143.6% to today’s price of $3,962. Silver, meanwhile, has risen 172.6% from its September 2022 low of $17.83, up to today’s price of $48.61.

With the exception of Golden Star Resources, which was delisted after its acquisition by Chinese gold producer, Chifeng Jilong, the following table illustrates the performance of the aforementioned stocks since their lows from September/October 2022.

| Metal/Company | 2022 – 2025 Gain (as of October 7) |

| Gold Price | 143.6% |

| Agnico Eagle | 325.6% |

| Barrick | 134.4% |

| Gold Fields | 485.3% |

| Kinross | 452.9% |

| McEwen Mining | 455.2% |

| Newmont | 113.2% |

| AVERAGE GOLD STOCKS | 327.8% |

| Silver Price | 172.6% |

| Coeur Mining | 594.4% |

| First Majestic Silver | 88.3% |

| Hecla Mining | 229.2% |

| Pan American Silver | 165.2% |

| SSR Mining | 81.3% |

| AVERAGE SILVER STOCKS | 221.8% |

Interpreting these findings, the same gold stocks would have to produce a further 806% worth of returns, to match their average returns from 2001-2008, which equate to 1,133.8% when excluding Golden Star Resources.

Even more staggeringly, the same silver stocks would have to continue an additional 1390.6% to equal their average returns from 2001-2008, which as the table from PAYDIRT shows, came out at 1612.4%.

Of course, this is not a perfect extrapolation, with many of the companies in the list more mature now, and therefore less prone to explosive increases, than they once were during the 2001-2008 bull market.

That said, our imperfect estimates also don’t take into account the flip side, which is the fact that some lesser known juniors produced up to 13,000% returns in historical bull markets, as Jeff notes in his book:

Up to now, the biggest return across our portfolio has been Amarc Resources, with a barnstorming 672% gain. That’s followed up on the silver side by Argenta Silver, whose performance sits at approximately 500%.

When considering the discrepancy between our top performers and those of 1979-80, AND when taking into account the fact that gold and silver prices are still rising relentlessly today, our bottom line is as follows…

History shows that gold and silver mining stocks have plenty left in the tank. Therefore, while today’s higher prices warrant greater caution, we think those who position wisely in the coming months stand a strong chance of striking PAYDIRT.

Are you making money in gold stocks? We are, and you can lock in the current price of Paydirt Prosector before prices go up October 15! Check out some of our gains, and if you like silver too you can get the “Bundle” package that includes both publications at a reduced rate. Join before October 15!