See Peter Krauth and Ted Butler at the Metals Investor Forum in Toronto February 27-28!

Jeff Clark, TheGoldAdvisor.com

I was robbed of my gold.

It’s a true story and honestly a little embarrassing. I had a bunch of gold Eagles and Maple Leafs stolen from my home, most of my personal holdings at the time.

The thing is, I thought they were secure: the coins were stored in a small safe, well hidden from view, with a key kept in a separate room. They had been delivered discreetly. And I never talked about them, even before I started working in the industry.

The thief had searched my home with meticulous desperation. Once he found the safe, it was only the work of a crowbar and hammer until my gold was gone.

I’ll never forget how violated, angry, and confused I felt. I’m sure you can relate if you’ve been victim of burglary, too. I’m just glad we weren’t home at the time… more on that in a minute.

That incident many years ago forced me to rethink how I store my precious metals. Hopefully you can learn from my mistake. Because at the end of the day, do you want your gold and silver so much at home that you’d hesitate for a second to let go of them?

This topic is so important that I decided to share my distressing experience, in the hopes that you can benefit from it…

When most people buy gold, they instinctively know it needs to be kept safe. It’s gold, after all, the ultimate form of money for millennia. Movies have been made about stealing it, smuggling it, recovering it from shipwrecks, and even just digging it out of the ground.

What many people don’t know is the best way to keep it safe. Most just end up hiding it at home, or in a safe deposit box at the local bank. But those methods aren’t risk-free, as I painfully found out. In fact, they come with more risk, and more cost, than many investors realize.

If you think you’ve been “careful” with your bullion storage plan, see how many of the following risks you’re exposed to with these common methods…

Most investors have gold shipped to their homes. I’ve heard of some that even display it proudly for friends and family. I can’t blame them—if you’ve ever held a gold or silver bar, you recognize the inherent emotion in that.

Usually though, common sense takes over, and they at least hide it from prying eyes. But, doing so exposes you to several key risks:

Handheld home fireproof safe. Small safes with a handle so it can be easily moved. These are usually designed to hold important household papers—not valuable bullion.

If you carried the safe into your house, a thief can carry it out. All they need do is find it, which is exactly what happened to me.

Large home safe, bolted to floor. Most investors think their bullion is secure with this type of safe, especially if it’s also hidden from view.

Regardless of whether it has a combination lock or a key, what will you do if a thief demands entry—while brandishing a gun or knife? This is not hyperbole: it happened to a close family friend, and the ending of the story was very unpleasant… his wife was tortured and he was killed, and the thieves made off with over half a million in bullion. Their kids have no recourse and no parents.

How many people know you own gold? You might think you’ve been careful about who you’ve told, but I bet more people know than you think…

You get the point.

If more than one person knows you have gold, or even just a safe, who have they told? And who did those people tell? Do your kids know? How certain are you that they don’t blather at school?

Have you talked about gold in an enthusiastic way with anyone? What have you said on social media? Could someone come away with the idea that you might own gold? If so, did they mention it to anyone? How would you know?

If a would-be thief hears a rumor that you might have gold, your entire home storage plan is sunk. Once the word is out, there’s no takebacks. You’re now a potential target, with the risk increasing as bullion prices climb.

Backyard Burial. Just dig a few holes in the backyard. If you’ve got the luxury of space, it gets gold out of the house. But consider:

Natural disaster. Beyond any personal tragedy, bullion stored at home can be lost to fire, flood, tornado, earthquake and any other natural disaster. Think of the victims to the 1,000+ tornados that touch down every year in the US.

How’s your wall safe holding up?

You have no control—and little recourse—should you become the victim of a natural disaster. Wouldn’t it be nice to know your gold is safe and sound and available to sell with a few clicks, despite what may happen around you?

What about insurance? Yes, you can insure your home-gold stored on a homeowner’s policy. However, the cost is usually exorbitant—2% or more of the value annually according to our survey, much more than a bullion depository. And it almost never covers a rise in the gold price. Further, insurance typically won’t cover negligence on your part or acts of God. And now a whole bunch of people know—agent, office staff, corporate office—which exposes you further to the ripple effect I mentioned above.

The simple truth is, while it makes sense to keep a small amount of gold and silver at hand for emergencies, any more than an amount you can afford to hand over willingly is ill advised. Maybe you’re the type who likes to base-jump without a helmet. I’m not, and I owe my family much more than that.

Some assume a bank safe deposit box is safe—but are you really comfortable with all these risks and restrictions?

The bottom line is that storing the bulk of your precious metals at home or in the banking system exposes you to many risks, any one of which could impose financial hardship for an indefinite period.

Don’t get me wrong… keeping some bullion close at hand is important. You should have a little readily accessible in the event of an economic or personal emergency. A financial “go bag” if you will. Secure it properly and tell only one other trusted confidant where it’s located.

After that, however, keeping a significant amount of your tangible assets at home or in a bank risks you losing too much in one mishap.

That is precisely how I store my gold and silver now. In fact, since I’m in the public eye, I keep none at home.

Over the past 20 years since I was robbed, my holdings have grown, and I now use several vaults. But I was recently attracted to a new one, a domestic vault program that is becoming another storage solution for me, one I like so much that we added them as an advertiser.

Here’s who they are, and why I like them and have opened an account.

What first caught my attention about Money Metals is they recently built an impressive new vault, which is now the largest depository in the US—even bigger than Fort Knox!

Now one of the largest bullion dealers in North America, Money Metals has been in business since 2010, launching its precious metals storage business in 2014.

But the growth in storage demand has been so dramatic that Money Metals recently built their new state-of-the-art secure bullion depository. They now have over 10,000 storage customers from among their overall customer base of 600,000+.

What I like about their program is that it’s a fully integrated system. Which means you can buy and sell directly from storage. Of course, you can also request delivery from your depository account at any time… and only pay the shipping cost to your destination.

Is the Money Metals Depository safe? Well, the county sheriff is a tenant in their other building literally across the street, where the Eagle, Idaho city police also maintain its headquarters.

More importantly, Money Metals’ facility is extremely robust, with physical barriers, access controls, mantraps, layers of alarm systems, laser curtains, Class 3 vaults, and many other security features, including their own in-house security team and dozens of armed employees on the premises at any given time. They’ve never had a loss.

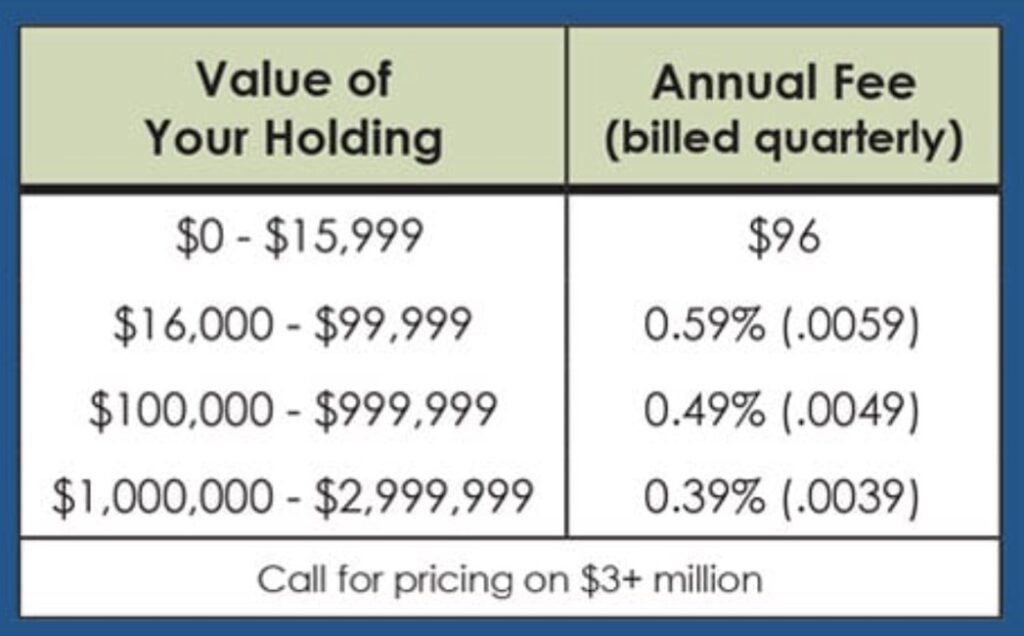

Also, storage costs are lower than Brinks. Here’s the fee structure for standard, non-IRA storage customers. For IRA customers working with various trustees that offer storage at Money Metals, the storage fees are even lower, usually just 19 basis points.

This storage agreement outlines the detailed terms and fees. Naturally they provide customers with disclosures, audits, and insurance certificates.

Of course you can buy for delivery from Money Metals, too. Orders over $198 ship free to any U.S. address (Canadian customers add US$50).

You can also send in metals you currently keep elsewhere, a feature not every bullion depository offers.

You can even visit your holdings in person! Or do it by Zoom. You can do this for free once a year. Just give them a heads-up to schedule it.

Money Metals also offers IRAs, and a program where you can take out a loan secured by your own holdings.

This truly is a full-service bullion system, which is why I opened my own account.

I believe every investor should use professional storage once they have a small stash close to home. This program is highly affordable and is easy to get started. No more excuses.

If you don’t want to make a new purchase and would rather send in precious metals you currently have elsewhere, start by creating your storage account here. You can also call Money Metals at 1-800-800-1865. They’re open 24/7 Monday through Saturday.