Subscription prices go up October 15! Lock in a lower permanent rate now! https://thegoldadvisor.com/product/the-paydirt-silver-bundle/

Subscription prices go up October 15! Lock in a lower permanent rate now! https://thegoldadvisor.com/product/the-paydirt-silver-bundle/

By Contributing Editor Doug Hornig

Should we really listen to what Goldman Sachs says? My friend and Paydirt editor Doug Hornig has an insight you might find interesting—and potentially useful as an investor.

The World is a Dangerous Place

I’m writing several days after Israel launched a massive air attack on Iran, with the intent of preventing that nation from developing nuclear weapons.

Obviously, this shakes up global markets.

Crude moved higher, since there is concern that Iran might attack tankers in the Strait of Hormuz, or close that waterway with some combination of mines, drones and surface suicide vessels. About 20 million barrels of oil a day pass through the Strait—nearly one fifth of global shipments. But the rise has been only about 10%.

Stock prices initially slid lower, though not dramatically, and have recovered much of the lost ground. The gold price jumped, as we would expect, edging toward $3500/oz., but it too has since pulled back.

Uncertainty reigns. The world wonders whether this new war will expand, and by how much. Will the U.S. get drawn in and become a more active player? If Iran attacks any American bases in the Middle East, that’s a foregone conclusion; there will be counterattacks. If Iran tries to close the Strait, that too would surely trigger American action. But what would a U.S. response look like? And are any of Iran’s “allies” going to get involved?

It’s complicated and the future, as always, is unknowable.

So far, the market reactions have been fairly muted. That said, we can expect that jitters about where this war is going will hang around—for weeks or possibly months—until there is a conclusion that could be globally applauded or catastrophic or anything in between. But, in general, a widening war will tend to drive global investors even more into gold, the ultimate safe haven. Which will tend to amplify the bull market that is already well under way.

Events in the Middle East are one factor. But let’s take a look at other drivers of the gold price. Unsurprisingly, we find that an important one is entwined with global conflicts.

What Happened in ’22?

Those of a certain age will remember a ’70s ad campaign with a tag line that became iconic: “When E.F. Hutton talks, people listen.” The original Hutton is long gone, but if we were to rewrite the slogan today, we’d replace it with the most influential investment bank, Goldman Sachs.

Goldman is not only a high-powered financial firm; it is deeply involved with the U.S. government and the making of fiscal policy. When it speaks, it’s safe to assume that it knows things. And for a while now, Goldman has been the most aggressive bank in predicting gold’s future.

Why?

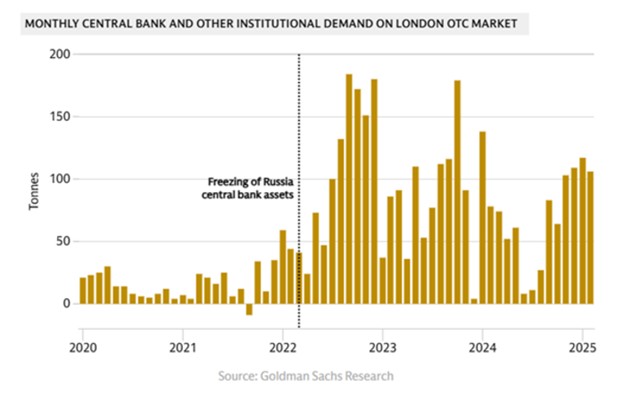

A Goldman Sachs bar chart tells the story.

In 2022, as a result of Russia’s invasion of Ukraine, the West (spearheaded by the U.S.) launched the largest coordinated asset freeze in modern history.

Over $300 billion of Russia’s foreign currency reserves held in Western central banks were frozen. This was unprecedented. In addition, dozens of Russian oligarchs, politicians, and Putin allies with assets stashed in the West were frozen out. Several major Russian banks were removed from SWIFT, cutting them off from international transactions.

Goldman’s chart reveals what happened next.

The world’s central banks took a hard look at the reserves they were holding, specifically U.S. dollars. They asked:

If the Russians can be locked away from their assets by the U.S., just like that, what would prevent the same thing from happening to us?

There was only one thing, a physical asset, that couldn’t be effectively frozen. So the central banks dramatically shifted toward gold diversification.

A Sea Change

From 2000-2009, central banks’ gold purchases were minimal, generally under 100 tonnes per year. From 2010-2020, demand picked up a bit, averaging around 400 tonnes per year. Then in 2021, with the Russian military action looming, purchases soared. With the invasion in February of 2022, followed by the sanctions, they went vertical.

In 2022, central banks added 1,136 tonnes, a record. In 2023, the number was 1,037 tonnes, and in 2024 it was 1,086. The pace has slowed a tad in 2025, but buying is still projected to be between 900 and 1000 tonnes by year’s end.

With the surge, in 2024 gold leapfrogged the euro as the world’s second-most important reserve asset for central banks, and not by a little. Bullion accounted for 20% of global official reserves last year, outstripping the euro’s 16%, and second only to the US dollar at 46%, according to the European Central Bank.

It’s important to note that these central bank transactions were conducted through the London OTC market. It’s not Maple Leafs and bling chains that are moving. We’re talking massive, 400-troy ounce “good delivery” bars. Which means they’re being removed from the market. They are going into the banks’ vaults and not coming out.

The banks are currently swallowing approximately 25% of annual gold production, thus limiting availability for other buyers. However, while central bank purchases were pushing the gold price higher, sales to individual investors remained relatively tepid.

Until now.

Buyers are coming in from the cold, and are they ever.

Q1 2025 investment demand jumped to 552 tonnes (+170% YoY), the highest since early 2022. Gold-backed ETF holdings led the way, jumping by 227 tonnes in Q1 and reaching 342 tonnes by April—the strongest surge in years.

Beyond ETFs, bar and coin purchases rose by +15% YoY to 325 tonnes in Q1. Demand was led by Chinese investors cashing in U.S. dollars for metal, marking one of the two highest quarters on record.

Domestic public interest was encouraged by outlets such as Costco, which is having trouble meeting demand for its in-store bullion sales.

The Crystal Ball

Goldman Sachs is leading the pack with some very aggressive price projections.

Others are more guarded. Bank of America, for example, sees gold declining to below $3100/oz. over the rest of the year. Deutsche Bank is extremely pessimistic, calling for a price between $2,450–3,050. Citibank predicts a $3,100–3,500 range.

Goldman, however, has kept raising the bar and now sees $3,700/oz. as the likely end‑2025 benchmark. But in a stressed scenario—such as a recession or global risk spike—the bank believes it could rocket to $3,900 or possibly up to $4,500/oz. at the extreme.

That’s as high as anyone is willing to go, but some are close behind. UBS sees a base case of $3,500/oz. at the end of 2025, with a $3800 upside and a downside floor of $3,200. J.P. Morgan’s numbers are also on the high side, at $3,675 in Q4 of ’25 and $4,000+ in Q2 of ’26.

A lot depends on what else is happening in the world, of course. Continuing turmoil in Ukraine and the Middle East will tend to support a higher gold price. So would interest rate cut(s) by the Federal Reserve. And FOMO (fear of missing out) looks like it’s just revving up among individual investors.

On the flip side, a recession might depress gold. And a large-scale stock market retreat always means lower prices for a while, as people sell their gold to cover paper losses.

But in general, when Goldman speaks, it’s usually wise to listen.

And remember that gold’s runup has happened despite little interest from retail buyers. That’s changing. And as it does, money is bound to flow into the gold mining stocks that are generating a lot of free cash flow even at current prices.

Best estimates are that gold’s market cap right now is between $21-23 trillion. But total market cap of all the world’s gold miners is a scant $500 billion. It won’t take much of a shift of interest to kick start the next boom in mining stocks, which in past cycles have always started out trailing the metal—then leveraging gains far beyond it. Gains in the junior minors could be spectacular, since the sector is down about 70% from its peak in 2012. Jeff Clark just released a Best Buy list of the companies he is personally overweight, ones he think could rival the gains we’ve seen in the past. It’s a bull market and it’s time to be long—check it all out here.